what is the income tax rate in dallas texas

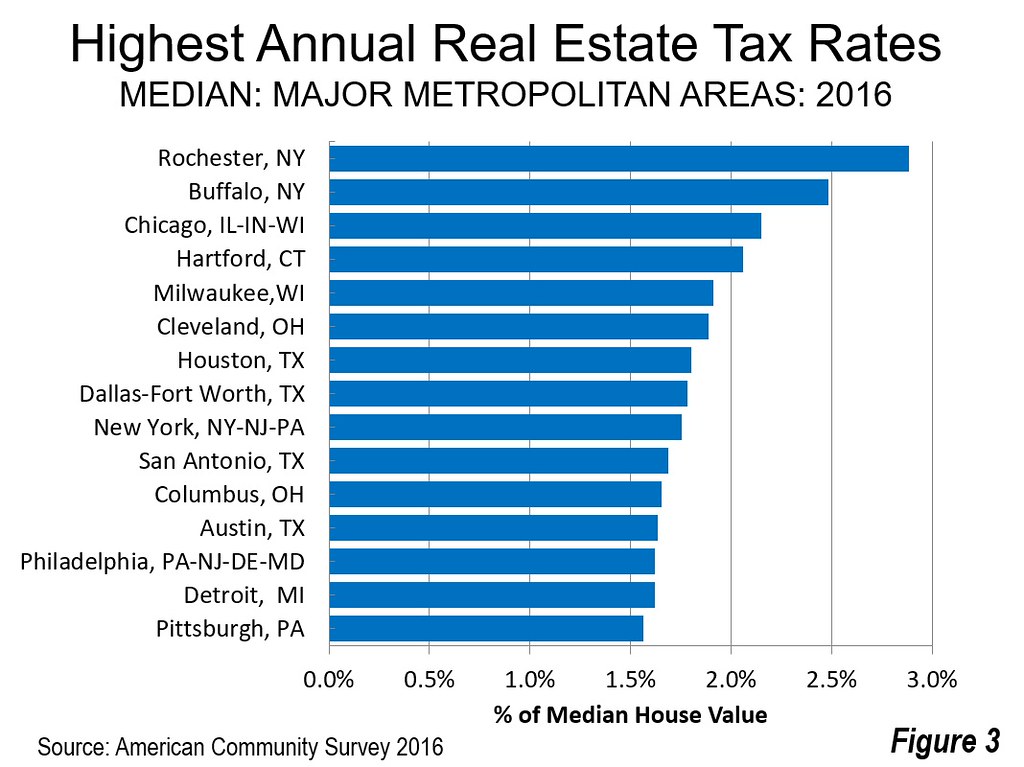

Texas has one of the highest average property tax. Dallas County is ranked 167th of the 3143 counties for property taxes as a.

A Mover S Guide To Setting Up Dallas Utilities

Minimum Tax Rate for 2022 is 031 percent.

. Texas has no state income tax. 10 -Texas Corporate Income Tax Brackets. What is the sales tax rate in Dallas Texas.

Maximum Tax Rate for 2022 is 631 percent. However revenue lost to Texas by not having a personal income tax may be made up through other state-level taxes such as the. Tax amount varies by county.

Texas income tax rate and tax brackets shown in the table below are. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. Texas is one of seven states that do not collect a personal income tax.

For instance an increase of. The Texas tax rate is 0 for income taxes. This is the total of state county and city sales tax rates.

Texas Income Tax Calculator 2021. The County sales tax rate is. Top state income tax rates range from a high of 133 percent in California to 1 percent in Tennessee according to the Tax Foundation study which was published in February.

Requires purchase and activation of a new iPhone 14 iPhone 14 Plus iPhone 14 Pro or iPhone 14 Pro Max with the Verizon Device Payment Program at 0 APR for 36 months subject to carrier. The rate increases to 075 for other non. You pay unemployment tax on the first 9000 that each employee earns during the calendar year.

You paid an average tax rate of 16. If your normal tax rate is higher than 22 you might want to ask your employer to identify your supplemental wages. The median property tax in Texas is 181 of a propertys assesed fair market value as property tax per year.

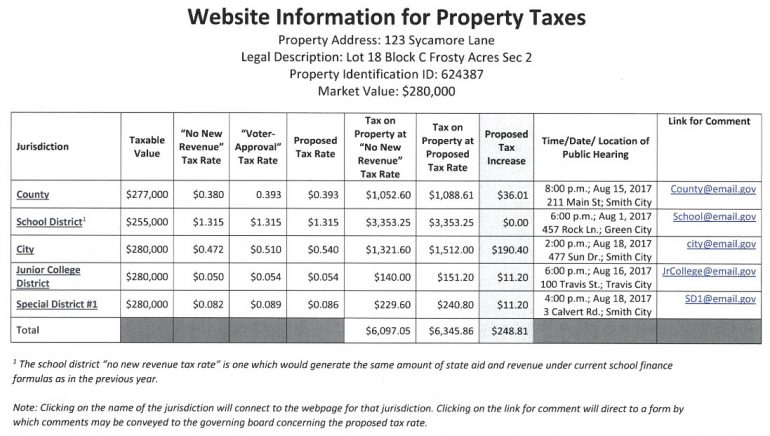

Dallas College DCCCD 0096038. The Texas sales tax rate is currently. Tax Bracket gross taxable income Tax Rate 0.

The average yearly property tax paid by Dallas County residents amounts to about 43 of their yearly income. Your average tax rate is 165 and your marginal tax rate is 297. Your average tax rate is 1198 and your marginal tax rate is 22.

They can either be taxed at your regular rate or at a flat rate of 22. The chart below shows state and local taxes paid as a percentage of income for the bottom 20 percent in income and the top 1 percent. Texas has no corporate income tax at the state level making it an attractive tax haven.

100 rows TOTAL TAX RATE. Texas income tax rate and tax brackets shown in the table below are. Texas state income tax rate for 2021 is 0 because Texas does not collect a personal income tax.

Taxation of 8120 applies to those making 50000 or more a year in the area of Texas. The states tax revenue primarily is derived from sales taxes and taxes on businesses and industry. What is the Tax Rate in Texas.

Texas does not have a corporate income tax but does levy a gross receipts tax. The minimum combined 2022 sales tax rate for Dallas Texas is. 2022 Tax Rates Estimated 2021 Tax Rates.

Texas has a 625 percent state sales tax rate a max local sales tax rate of 200 percent and an average. If you make 70000 a year living in the region of Texas USA you will be taxed 8387. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Only the Federal Income Tax applies. Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax. By the Corporation for Enterprise Development.

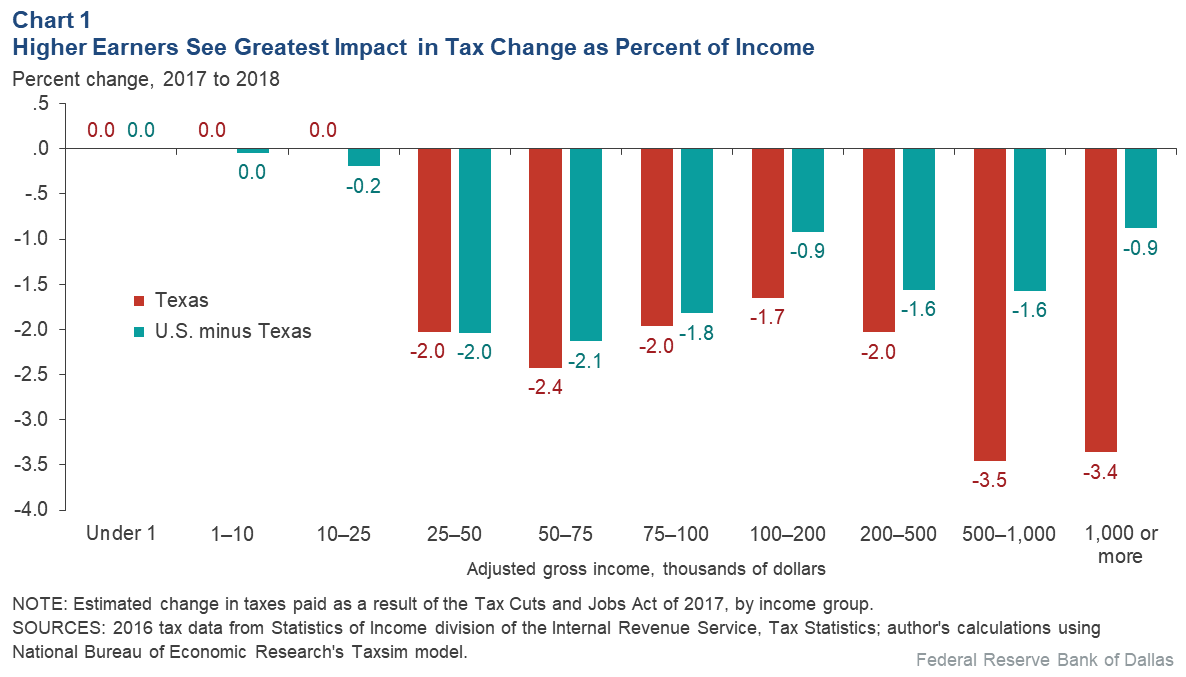

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Dallas Unveils 4 51 Billion Proposed Budget And Reduced Property Tax Rate Candysdirt Com

Texas Tax Rates Rankings Texas State Taxes Tax Foundation

Most Texans Pay More In Taxes Than Californians Reform Austin

Living In Dallas Everything You Need To Know Cool Box Portable Storage

Ever Wonder Why Your Federal Income Taxes Are So Tricky 2017 Tax Rates Friday Treet Ents

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

U S Cities With The Highest Property Taxes

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

10 Things To Know Before Moving To Dallas Tx

Will The Texas Isd M O Property Tax Rate Be Eliminated Ke Andrews

Schedule C Income Mortgagemark Com

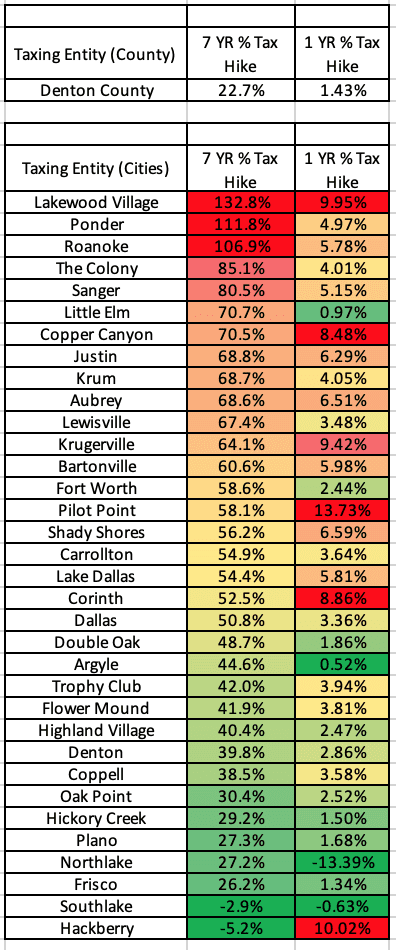

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Significant Changes Coming To Texas Property Tax System Texas Apartment Association

Taxes International Students And Scholars Office The University Of Texas At Dallas

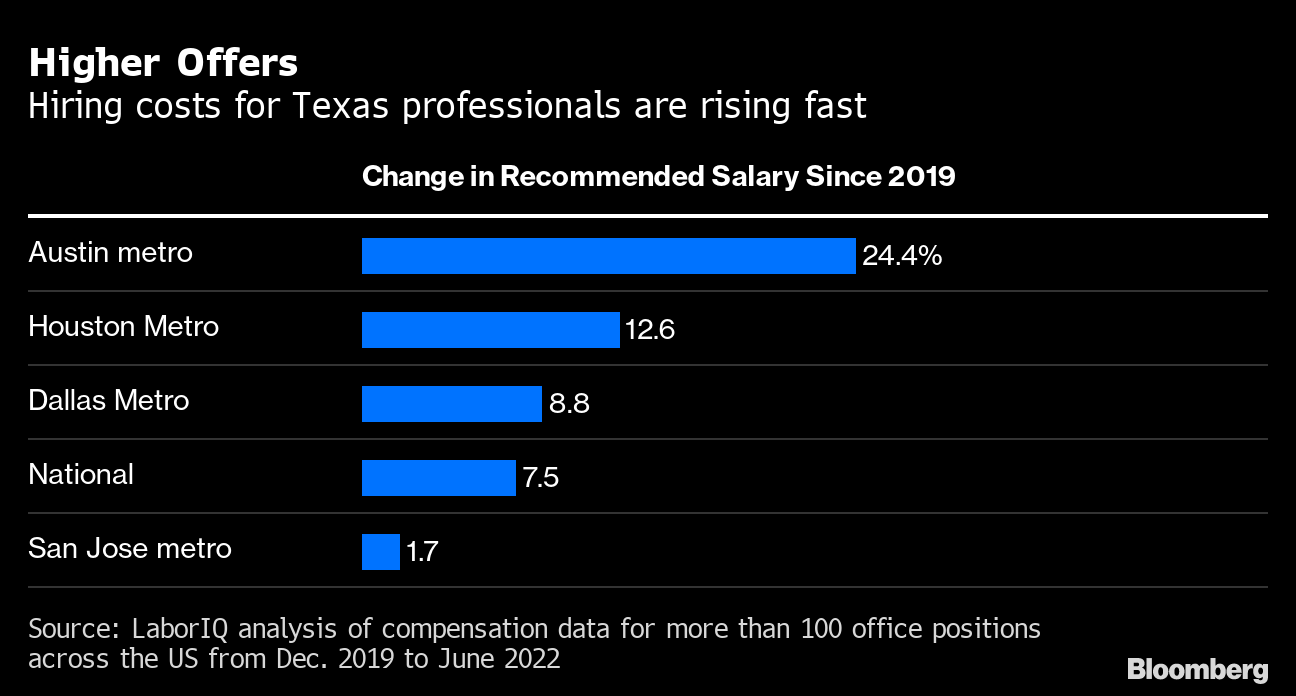

Want A Raise Salaries In Texas Are Rising Closing Gap On Silicon Valley Bloomberg